In a context where information overabundance risks becoming paralyzing noise, financial advice is evolving into a computational and strategic practice, where access to structured and contextualized data becomes a lever of competitive advantage. Technological intelligence, embodied in evolved platforms such as FIDAworkstation, enables the advisor to navigate regulatory complexity without succumbing to bureaucracy, transforming documentary obligation into a structured and personalized asset narrative. Between databases that take the form of living encyclopedias of finance and functionalities capable of accommodating even the uniqueness of unlisted assets, the new paradigm is no longer just one of efficiency, but one of deep understanding, radical transparency, and tailored enhancement of each asset.

When norm meets innovation

In the contemporary financial ecosystem, the advisor is more than just an investment intermediary. He is an architect of complexity, a sophisticated interpreter of an ever-changing regulatory and technological reality. The profession today requires not only financial expertise, but also technological mastery that transforms regulatory constraints into strategic opportunities.

The introduction of MiFID II regulations marked a definitive watershed in financial advice. Transparency, traceability of choices, suitability with respect to the investor’s profile and, last but not least, the duty to act in the client’s best interest impose a procedural rigor that is ill-suited to improvisation or sloppy tools.

The advisor is called upon to document every step, justify every choice, file every piece of information with surgical precision. An undertaking that, without adequate technological support, risks turning into a bureaucratic maze.

But what data are really needed? A modern financial database must be a complex and articulated ecosystem. No longer a simple archive, but a living organism capable of returning a multidimensional view of financial instruments.

The features of an evolved financial database

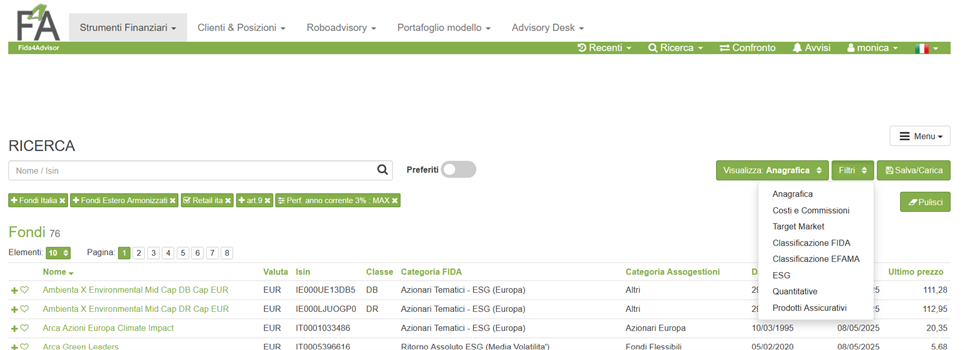

In a context in which data quality is the new competitive advantage, a financial database can no longer be limited to being a simple ordered collection of information. It must rise to the role of a strategic infrastructure, capable of supporting complex decision-making processes, regulated activities and increasingly demanding advisory models. Its architecture must be designed to serve, with equal efficiency, the quantitative analyst, the asset manager, the financial advisor and, not least, the regulatory supervisor. Let us therefore see what are the indispensable properties that determine its excellence.

Comprehensiveness means not only breadth of coverage-that is, including stocks, bonds, funds, ETFs, derivatives, alternative instruments, indices, rates, and currencies-but also vertical depth: long histories, management indicators, risk metrics, ESG analysis, corporate data, sector classifications. In other words, a comprehensive mapping of the entire investible universe, to avoid a suboptimal choice resulting from an information gap.

Homogeneity is the prerequisite for comparability. A database worthy of the name must harmonize heterogeneous data from different sources and jurisdictions, translating them into a common language. It means, for example, applying consistent criteria when tracking performance, categorizing instruments, or normalizing returns. Without this dimension, every benchmark is flawed, every screening is biased.

Daily updating is, now more than ever, a sine qua non. Timeliness of data allows not only to meet regulatory requirements (think MIFID II or SFDR), but also to capture real-time rebalancing opportunities, operational signals or latent risk changes. An outdated database is a silent danger, working against the effectiveness of advice.

Reliability means being able to rely on certified, auditable sources and data quality processes overseen by specialized teams. But it also means data integrity: consistency across sections, traceability of changes, robustness in aggregations. This is not an optional extra, but a prerequisite for building portfolios modeled on quantitative metrics and subject to ex-post validation.

Flexibility implies the ability of the database to dialogue with different systems, adapt to proprietary flows, integrate via APIs, and at the same time offer user-friendly interfaces. For the consultant, this translates into the ability to query the database without writing code, while for the developer it means having an open, modular infrastructure that plugs into even complex application ecosystems.

Transparency is what distinguishes a data provider from an epistemological partner. Knowing computational methodologies, being able to access classification criteria, understanding the meaning of each available variable-all of these make the database not just a working tool, but an ally in forming critical judgments, writing qualified reports, and documented management of conflicts of interest.

Finally, scalability: the ability of the system to grow as user needs grow. Whether expanding the number of instruments monitored, adding new analytical metrics, or adapting to a paradigm shift in advice (e.g., from the commission model to the fee-only model), the database must be able to evolve seamlessly. A prerequisite for those who aspire to structure advisory architectures that are robust, replicable, and sustainable over time.

In short, a state-of-the-art financial database is not just a container, but a dynamic organism that interconnects data, technologies and methodologies, becoming an integral part of the investment process. This is what FIDAworkstation has chosen to embody since its inception, thanks to an infrastructure that combines technical rigor, systemic openness, and a continuous watch over information quality.

Technology as an epistemological ally

Platforms like FIDAworkstation are not mere technological solutions, but true intellectual partners of the consultant. They do not just provide data, but contextualize it, relate it, and transform it into strategic knowledge.

The real revolution lies in the breadth and depth of the database. Numbers that are not mere figures, but an unprecedented information ecosystem.

In the kaleidoscopic landscape of modern finance, Investment Funds undoubtedly represent the most structured and ramified aggregate, with a numerosity that laps 170,000. In this constellation, heterogeneous natures coexist: from Closed-end Funds to Pension Funds, via Insurance Funds to Speculative Funds. Exchange Traded Products – comprising ETFs, ETNs and ETCs – exceed 27,000 instruments, configuring themselves as the lynchpin of passive management and efficient allocative logic. On the structured finance side, Certificates excel with over 300,000 issues, expressing design vitality and adaptability to the most sophisticated market needs. Completing the mosaic are some 30,000 Equities, 32,000 Bonds, 1,700 Currencies, 1,400 Indices, over 4,000 Insurance Policies and just under 400 Separate Accounts. A protean, stratified universe in which each instrumental class contributes to compose the morphology of contemporary asset management and investing.

But beware: these figures do not just describe the current state of the market. They also include extinct instruments, no longer tradable but far from irrelevant. On the contrary, their presence is crucial to returning a philological and complete narrative of portfolios over time. Ignoring decommissioned instruments is tantamount to severing the roots of a strategy: one loses the links, misplaces the evolutionary trajectory, and compromises the possibility of conducting reliable backtesting and ex post reconstruction of allocative decisions.

We therefore speak of more than 685,000 financial instruments not as a dry collection, but as a living encyclopedia of global finance. A pulsating organism, where each ISIN is the vector of a story, a performance dynamic, a risk appetite or a broken promise.

And this is where technology reveals its transfiguring power: this critical mass of data is decoded, correlated, made intelligible. Financial advice is evolving: from a craft to a computational discipline, in which data science meets the art of management to generate strategic insights to support every investment choice.

The Product Sheet: an organized universe of information

The modern product sheet is not a static document, but a dynamic, multidimensional narrative that offers a holistic view of the financial instrument. Each section is a piece of an extremely rich and articulated information mosaic:

- Master and Identifying Information: A comprehensive master file that goes beyond mere identifying information. It includes details such as ISIN code, instrument type, domicile, classification (Retail/Institutional), management company with contact coordinates. These are not just labels, but coordinates that immediately contextualize the instrument in the financial landscape.

- Comparative Benchmarks: Sophisticated comparative analysis that not only shows official benchmarks, but puts them in context. They are presented alongside category-specific FIDA benchmarks, allowing for a multidimensional comparative reading of performance.

- Historical Performance: A detailed chronological analysis ranging from annual returns to performance over multiple time horizons. Not just numbers, but a narrative of the historical evolution of the instrument.

- Multimetric Risk Analysis: An in-depth exploration of the risk profile that goes beyond classic volatility. Includes sophisticated metrics such as negative volatility, maximum drawdown, beta, R-square, tracking error volatility. A comprehensive x-ray of instrument riskiness.

- Financial Efficiency Metrics: Proven meaningful risk-return indicators, such as Sharpe Ratio, Sortino Ratio, Alpha, Information Ratio, capable of providing concise interpretations of the instrument’s ability to generate efficient returns.

- Detailed Portfolio Composition: A granular analysis that reveals the anatomy of the instrument. Exposure by asset class, geographic, sector, and currency distribution, and the top ten positions with their percentage weights. A complete map of the underlying investments, which returns the breakdown of the fund portfolio fundamental to understanding the declination in the concrete of the investment policy.

- Integrated ESG Ratings: A sustainability analysis that goes beyond simple scores. It includes SFDR ratings (Article 6, 8, 9), ESG strategies adopted, sustainability ratings, and possible controversies. Finance meets social responsibility in a multiplicity of ways and effects.

- Target Market: A timely profiling of the ideal investor. Not just type (Retail/Professional), but a comprehensive mapping: level of knowledge required, ability to sustain losses, risk tolerance, specific investment objectives.

- Administrative and Management Details: Detailed fees (management, entry, performance), regulatory classifications, share class information, quotes, asset evolution. Comprehensive administrative overview.

This product sheet is not a document, but a complete financial narrative. Each section is a chapter in an analysis that turns data into strategic knowledge.

Strive for completeness and total customization with the External function

Beyond the predefined universe of financial instruments, FIDAworkstation offers a revolutionary concept of customization: the External feature. This feature transforms the database from a closed catalog to a dynamic and fully customizable ecosystem.

External is not simply a data entry tool, but a bridge between the standardized financial world and each client’s unique wealth of assets. It allows any valuable asset to be integrated into the portfolio, crossing the traditional boundaries of listed financial instruments.

The range of External instruments is surprisingly broad and diverse:

Traditional Financial Products:

- Stocks

- Bonds

- Funds of different types

- Derivatives

- Currencies

- Bank deposits with and without interest

Unconventional Assets:

- Collectibles (art collections, coins)

- Real estate and land

- Alternative private debt, real estate and private equity funds

- Policies and asset management

- Structured products

- Credit instruments

Methodological Flexibility

The inclusion of an External tool is a structured process in order to guide the user through an otherwise critical path:

- Compilation of detailed master data

- Definition of the historical series start date

- Entry of a unique identification code

- Specification of currency

- Ability to detail FIDA classifications

- Tracking of investment/disinvestment income and flows

Every deposit or withdrawal is automatically factored into the relevant portfolio, ensuring smooth and integrated reporting.

The real revolution lies in the ability to enhance unconventional assets. A collector can now integrate his art holdings, an entrepreneur his alternative investments, a professional his receivables. Not a static view of assets, but a dynamic and personal financial narrative that is fertile ground for the development of a trusting relationship and fruitful collaboration between advisor and investor.

Monica F. Zerbinati

Richiedi la prova gratuita a welcometeam@fidaonline.com